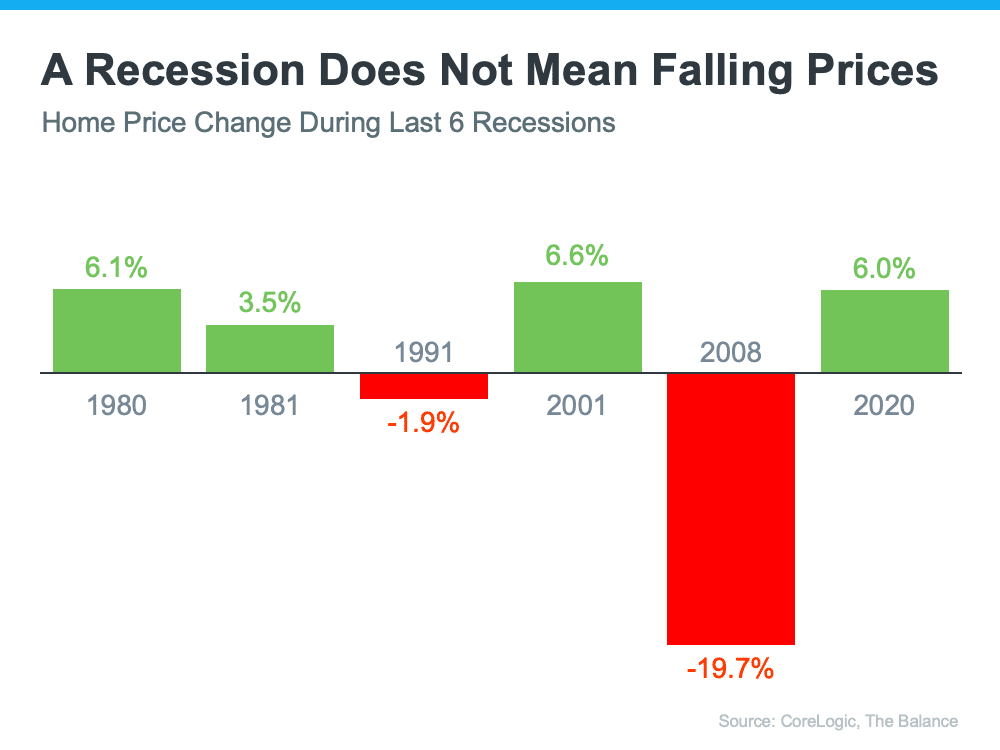

The idea that a recession automatically leads to a housing crisis is a common misconception. While it’s true that economic downturns can have an impact on the housing market, history has shown that the two are not always directly related. In fact, past recessions have had vastly different effects on the housing market, depending on a variety of factors such as lending practices, interest rates, and supply and demand. It’s essential to look beyond the surface-level assumptions and examine the data before drawing conclusions about the relationship between recessions and the housing market.

During the Great Recession of 2008, the housing market was hit hard. However, the cause of the crisis was not solely due to the recession itself. Rather, it was a combination of risky lending practices, an oversupply of new homes, and a decline in home values that ultimately led to the crisis of 2008.

On the other hand, during the recession of the early 1980s, the housing market actually saw an increase in sales and home values. This was due in part to falling interest rates, which made it more affordable for people to purchase homes.

The following image shows how home prices have changed during the last six recessions the United States has experienced.

It’s important to note that a recession can certainly have an impact on the housing market, but it’s not a guarantee that a crisis will occur. Factors such as local market conditions, supply and demand, and lending practices all play a role in determining the health of the housing market.

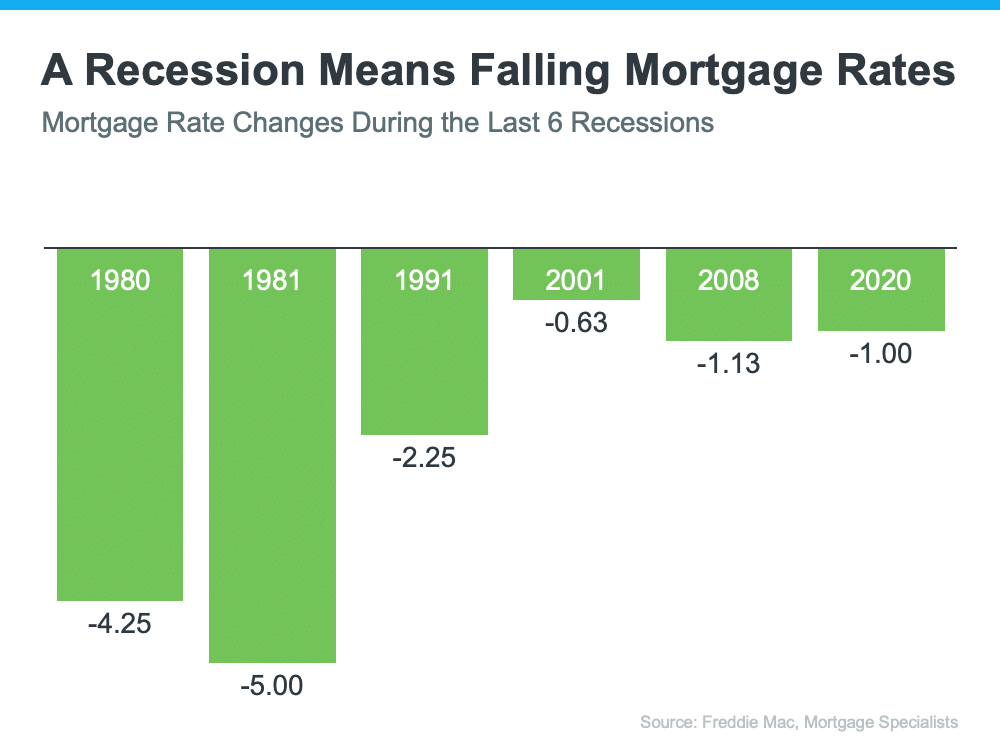

In truth, what a recession actually means in real estate is that mortgage rates are dropping, which, as we witnessed in 2021-2022, is considerably a good thing! Historically, as the economy slowed, mortgage rates dropped, which created demand in the real estate market.

The following graph will show you just how far rates dropped during the last six recessions in the United States. In 1981, we saw a rise in activity in the real estate market, where we saw many of our parents buying up real estate once mortgage rates dropped.

According to the article written by Keeping Current Matters, Bankrate is on record detailing why this happens.

Over the last year, the fluctuation and increase in mortgage rates have been brutal as the FED responded to high inflation. The current 30-year fixed rate has been hovering between 6-7% over the last few months, which has directly impacted affordability with many would-be buyers.

While there are some signs of a potential slowdown, there are also positive indicators such as low unemployment rates and steady job growth. While it’s impossible to predict the future, it’s essential to consider all factors before jumping to conclusions about the state of the housing market during a recession.

If you’ve been waiting for the market to crash before buying, the bad news is that you might be waiting a while. It’s important to connect with a licensed professional who understands the market and what changes can be anticipated. This licensed professional will be able to help you outline the risks of waiting any longer, while also helping you to navigate the current market if you so choose to buy!

Choose Furner Realty Group today to get started!

Sourced from Keeping Current Matters