The Advantage of Owning a Home

When it comes to owning a home there are many key benefits, including financial stability, building wealth, tax benefits, a permanent place to call home, and a sense of belonging to a community. Owning a home may seem like an intimidating task, but the payoff is highly rewarding.

Financial stability

as a homeowner, you’ll have control over your expenses and have a sense of reliability, especially as a first-time homebuyer. For some, paying monthly on a mortgage may be less expensive than most rental rates (cha-ching $$)!

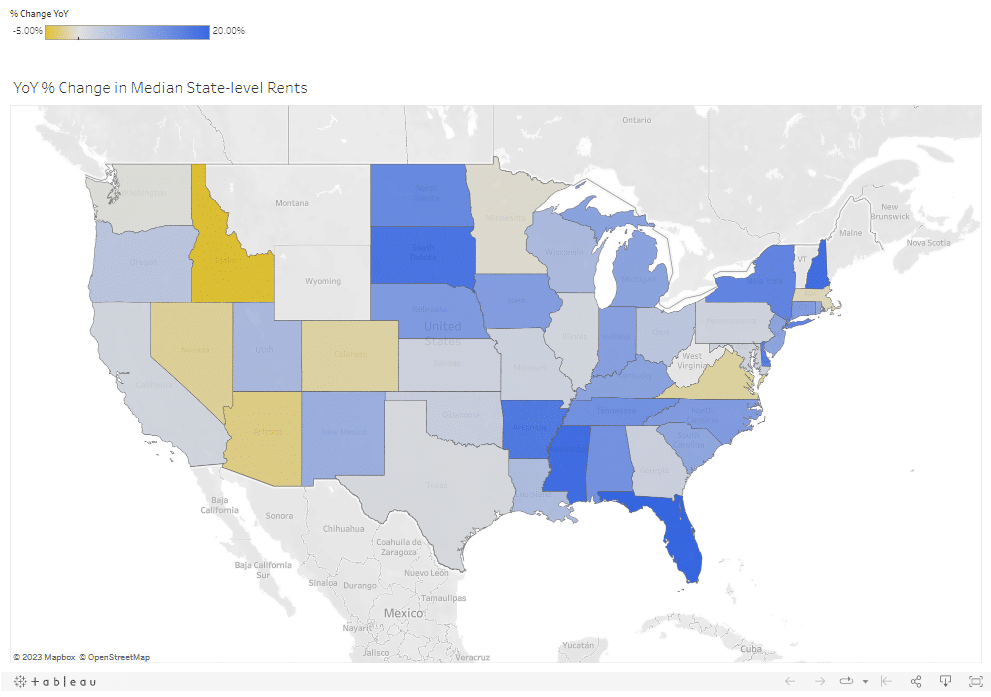

The reason for this is that inflation commonly impacts rental rates. According to the latest report by Rent.com, the median rent increased by 15.57% in January 2022. But, when you’re a homeowner with a fix-rate mortgage you’ll enjoy the perk of a set monthly payment that will never change, regardless of inflation. Below is a look at the median % increase in rent state-by-state in the United States.

Financial Strength

Making a monthly payment on your mortgage will help to steadily build the equity in your property. While monthly payments to your landlord will offer you no return. So, if you’re a first-time homeowner, it might seem obvious that owning a home can help you to strengthen your financial assets.

Here are a few ways that you can help to rapidly increase your home’s equity.

- If there are no penalties associated, make payments directly toward your principal.

- If it makes sense with the rate environment and your financial situation, consider refinancing to a shorter-term loan.

- If you haven’t purchased yet and can afford it, consider making a larger down payment on your next property.

Begin checking off home improvement projects that will add value to your home, such as a kitchen renovation or bathroom renovation. If you’re not sure what projects will add the most value, speak to a trust-licensed Realtor for guidance.

Tax Benefits

Arguably one of the greatest advantages of homeownership is the tax deductions that may be offered to you, meaning money back in your wallet! Tax deductions can vary and may include some of the following, expenses on home improvement, insurance payments, claims on the home, and whether you’re a first-time homebuyer. If you’re unsure what tax deductions you may qualify for, as a homeowner, speak to a financial advisor or ask your Realtor for a recommendation for someone to speak to.

Permanent Residence

If you’ve moved already in the past, then you know that moving from place to place can put a lot of stress on the mind, body, and soul, especially if you’ve had to do it more than once over a period of a few years. As a homeowner, you’ll have a permanent place to call home! Even if your current residence ends up not being your “permanent” residence, you’ll be relieved by the notion that you won’t have the lingering stress of your lease being “up” and a need to decide where you’ll go next.

Sense of Community

Buying a home creates a sense of community in numerous ways. Not only does it offer you the benefit of long-lasting relationships with neighbors and others in your local neighborhood, but homeownership also tends to drive a sense of participation in the local community – whether it’s dining out at local restaurants, supporting local charities, or attending community events. Truly, settling down can provide you with a system of support and will ultimately bring more comfort into your life.

Whether you desire financial stability, building wealth through ownership, or crave a sense of community, owning a home has it’s advantages. If you’re ready to make the next move, or have questions about buying or selling your home, Furner Realty Group would be happy to talk you through what you’re next steps should be. Reach out to a member of our team today to get started!

For more home-buying tips and insights, visit our “Best Buyer Tips” board on Pinterest.